Best 10 Forex Brokers Offering ECN Trading Accounts

Today, the number of new traders venturing into the forex market is on the rise. Most times, for these beginners, the starting point is as hard as when they can imagine. With newer brokers seizing every opportunity to capture these new traders, it poses a threat to traders regarding which broker offers the best service.

Choosing a forex broker is never an easy task, even for professionals. We have recently seen brokers opening their doors to an electronic communications network (ECN) form of trading. It might sound odd for new traders, but ECN brokers are brokers that use electronic communication. These brokers are different from the traditional desk brokers you know.

The advent of technology has contributed to the widespread usage of ECN brokers since they offer lower spreads. These brokers help facilitate sellers and buyers to meet and execute their trades. In other words, ECN brokers match a buyer and seller to trade the forex market.

ECN Forex Broker Benefits

The most noticeable advantage of an ECN forex broker is the opportunity to get advantageous market conditions.

- Fast Execution – The typical reason why ECN is considered the purest breed of broker in the Forex industry is the execution time. The ECN broker guarantees all trades to be placed immediately with no slippage or re-quotes to bother about for traders.

- Low Spreads – Aside from the rapid execution, the additional part of trading through an ECN broker is the tight spreads. However, it must be quoted that while the spread is usually the lowest compared to any other type of broker, but it can go equally high in situations where the market becomes uncertain, especially during any major news events.

- Safe and Reliable – Although using an ECN broker always is the top preference for the traders to have better trading conditions and environment. It is also chosen more due to higher safety and reliability, with no manipulation concerns lingering.

All ECN brokers provide traders with direct access to liquidity powers. Therefore, price manipulation becomes quite impossible. However, in using an ECN forex broker, your commission/spreads become higher than a non-ECN broker in various situations.

Choosing an ECN Forex Broker

Before we talk about the best 10 forex brokers offering ECN accounts in 2021, it is critical to know what to look for when choosing an ECN forex broker.

- Regulation and Location – Since brokers operate online, the issue of location might not be a real factor to consider. Nevertheless, all brokers try to provide local client service, which means you will find a broker that offers your local language services. In the area of regulations, many prefer to deal with a regulated broker because the quality and reliability of the service usually depends on it.

- Trading Instruments and Range – Look for an ECN forex broker that offers many different assets for trading. Remember, not all ECN brokers have a wide range of instruments.

- Trading Platform and Spreads – You need to find out if the broker offers different trading platforms such as cTrader, MetaTrader, Currenex, CQG, and so on. Additionally, if the spreads are very high, it is a pointer to look somewhere else.

- Payment and Deposit Methods – Another thing to consider is the payment method, which should include Bank Transfer, Debit Card, Skrill, Neteller, Cryptocurrencies, and other payment methods. Besides this, you should check the minimum deposit required before choosing an ECN forex broker.

What's This Review About?

Choosing a forex broker is never an easy task, even for professionals. We have recently seen brokers opening their doors to an electronic communications network (ECN) form of trading. It might sound odd for new traders, but ECN brokers are brokers that use electronic communication. These brokers are different from the traditional desk brokers you know.

The advent of technology has contributed to the widespread usage of ECN brokers since they offer lower spreads. These brokers help facilitate sellers and buyers to meet and execute their trades. In other words, ECN brokers match a buyer and seller to trade the forex market.

In this review, we will compare the essential features to enable you to make an informed choice when you want to choose an ECN forex broker. To make it easier, we will look at the following:

- Trading platforms

- Trading market

- Deposit and withdrawal options

- Customer support

- Account types

- Pros

- Cons

- Verdict on each broker

If you want an all-inclusive and honest review of the best ECN forex brokers in 2021, you are on the right path to starting your journey. Your success in trading forex is dependent on the forex broker you use. Because with the right strategy but the wrong platform, you will work like an elephant and eat like an ant.

Are you ready to begin your trading adventure? Let's get started!

#1 FXOpen

Site: FXOpen.com

FXOpen is an ECN forex broker that offers different instruments on various trading platforms. The company started as an educational center, which offers multiple courses relating to the financial industry. However, in 2005 the company began offering broker services with offices in different parts of the world, including Australia, New Zealand, Australia, and the UK.

FXOpen gives traders access to various instruments in different markets, including commodities, indices, and currencies. Furthermore, it also offers cryptocurrency trading through cryptocurrency CFD.

Trading Platforms

FXOpen offers traders three different platforms when it comes to a trader. You can use the popular MetaTrader 4, MetaTrader 5, or TickTrader. The MetaTrader platform has other features for both new and professional traders.

Furthermore, you have access to three order types (market, stop, and limit), automated trading, over 50 inbuilt indicators, rich historical data, trading signals, and one-click trading. Besides this, you can develop the platform and access your account on various devices.

The TickTrader is for non-UK traders; the platform offers a similar feature to the MetaTrader. Its features include strategy back tester, detailed charting system, advanced technical tools, level 2 pricing, customizable, user-friendly interface, etc.

Trading Market

FXOpen offers traders four essential markets in the financial industry. These include:

- Cryptocurrencies – Traders can trade over 40 crypto CFDs, including Ripple, Ethereum, and Bitcoin

- Commodities – Trade commodities such as silver, gold, and crude oil

- Indices – Access to nine global indexes such as S&P 500 and FTSE 100

- Currencies – Trade over 45 minor, major, and exotic currency pairs

Deposit and Withdrawal Options

FXOpen offers different options when you want to deposit. You can deposit in GBP, EUR, or USD. Although some options come without any fee, it is essential to note that Skrill and Neteller deposit has a 2% and 1% fee, respectively.

However, Trustly, bank wire transfer, and credit/debit cards are free when depositing. Furthermore, if you decide to use Webmoney, you have to pay a deposit fee of 3.5%. For cards, the minimum deposit is 10 USD, GBP, or EUR. However, with other options, the minimum deposit is 50 in your respective currency.

Withdrawal also comes with the same fees as the deposit. However, bank wire transfer takes a maximum of three business days, whereas cards take 2 – 5 days. The minimum withdrawal when you want to use a bank wire transfer is 50 EUR, USD, or GBP. Other options come with a minimum withdrawal of 10 EUR, USD, or GBP.

Account Types

FXOpen offers four different types of accounts, which include demo, micro, mini and standard account. Each account has its unique features from which traders can make the best option that suits their trading.

Customer Support

FXOpen offers various customer support for its customers, including live chat (Facebook Messenger and WhatsApp), customer support telephone, and email. It provides services or assistance on various issues ranging from withdrawal problems, bitcoin deposits, and proof of address challenges.

Pros

- Multiple trading platforms

- Real ECN forex broker

- Decent cryptocurrency fees

- Low spread and commission

Cons

- Limited range of CFDs

- High minimum fees for UK traders

Verdict

FXOpen offers a competitive trading opportunity for all traders – new and professional. However, it has limited educational materials for traders; the low spread and commission entices traders. Besides this, it has a track record for quality customer support and execution of trades.

#2 RoboForex

Site: RoboForex.com

RoboForex is another online broker that offers seamless trading opportunities for traders with assets on different trading accounts. It provides various options in terms of trading platforms. The company started in 2009 and has its headquarter in Belize besides being fully regulated by the International Financial Services Commission.

Additionally, RoboForex offers traders over 10,000 trading instruments, four trading platforms, two investment platforms, and eight asset classes.

Trading Platform

RoboForex offers traders four different trading platforms to trade forex. Traders can use MetaTrader 4, which is suitable for new and advanced traders. The MetaTrader 4 comes with basic graphic tools, over 50 indicators, and three order execution types.

However, the MetaTrader 5 has additional features, including market depth, hedging and netting capabilities, four types of order execution, and graphic tools. You can use the web version or download the standalone version of the MetaTrader on your PC.

Another option available for the trader to use is the cTrader and R Trader trading platforms. The cTrader platform provides over 54 technical indicators, nine types of orders, 14 timeframes, and Level II pricing. You can access the platform using a browser or download it on your PC. Nevertheless, the R Trader platform comes with a classic design with nine graphical tools, 13 technical indicators, and an automated strategy tester.

Trading Market

RoboForex provides traders with over 12,000 global stocks, 40+ currency pairs, 10+ indices including NASDAQ, Dow Jones (US30), and 100 commodities such as ETFs and oil. Besides this, it offers over 26 cryptocurrencies, including crypto-indices, a unique product that allows traders to trade on numerous cryptos at once.

Deposit and Withdrawal Options

RoboForex complements its uniqueness with an unrivaled selection for its withdrawal and deposit options. The deposit option comes commission-free with various deposit process – Perfect Money, Rapid Transfer, iDEAL, Yandex Money, SOLO, bank wires, credit/card deposit, etc.

Nevertheless, RoboForex has 13 withdrawal methods depending on your location. The withdrawal process takes only a day, with commissions ranging from 0.5% to 2.8%. The minimum deposit for all accounts besides the R Trader account is 10 USD/EUR. However, for R Trader, a minimum of 100 USD.

Account Types

RoboForex offers different kinds of accounts for its client. These include ECN account, standard account, Micro account, zero spread account, mini account, Islamic account, and demo account.

Customer Support

RoboForex offers numerous support systems for its client with over 12 languages, including English, Spanish, Arabic, Indonesian, and Malaysian. The support is available 24/7 with access to live chat, such as WhatsApp, Facebook Messenger, Skype, and Viber. Other options available, including an online callback form, telephone number, and email.

Pros

- Low minimum deposit

- Allows hedging and scalping

- Multiple account types

Cons

- Does not accept US clients

Verdict

RoboForex has established itself as a reputable ECN broker that offers different asset and trading platforms. Besides being a highly regulated broker, it provides negative balance protection with security for traders. In general, RoboForex is a reliable broker in all ramifications with the inclusion of ECN accounts for its trading options.

#3 FXTM

Site: ForexTime.com

ForexTime, popularly known as FXTM, began operation in 2011 and holds authorization and license from UK Financial Conduct Authority. Along with the Cyprus Securities and Exchange Commission, the Financial Sector Conduct Authority of South Africa, and the Financial Services Commission of the Republic of Mauritius.

It offers over 250 financial CFD instruments, including commodities, currencies, metals, indices, and stock operating six different account types. These accounts are divided into two distinct categories – ECN and a standard account. It offers different varieties of commission-based and free trading that have a minimum deposit with spreads. Today, FXTM has become a reliable ECN broker that many traders rush to when trading forex.

Trading Platform

FXTM offers traders different platforms to trade. You can choose from MetaTrader 4 or MetaTrader 5 for laptop or desktop users. These platforms come with unique features such as inbuilt technical indicators, access to trading signals, etc.; you have the option of using the web, desktop, or mobile version in trading on the platform.

Trading Market

FXTM offers various kinds of instruments to traders, depending on the country of residence. However, you can trade the following market:

- CFDs for commodities and Indices

- Forex

- Shares CFDs (Google, BP, Apple, etc)

- Spot metals (Gold, Silver)

Deposit and Withdrawal Options

It has numerous deposit options for traders, which include Skrill, Mastercard, Visa, Neteller, and Maestro. Its deposit from commission-free; furthermore, the minimum deposit required depends on the trading account you decide to operate. The standard and ECN account has a minimum deposit of 100 dollars, pounds, or euro.

However, the ECN zero account for MT4 and MT5 comes with a minimum of 500 dollars, pound, or euro. You can use a minimum of 10 dollars, pound, or euro for the cent account, whereas the FXTM Pro requires a minimum amount of $25000 in such currency. For withdrawal, you can use the same payment platform used in depositing.

Account Types

FXTM offers different account types, with each having unique features. The standard account comes with three different currencies options – US dollars, Pounds, and Euros. You can also trade using a cent account for those who don't want to invest much; the ECN zero account comes with narrow floating spreads, no swap with both hedging and scalping.

Additionally, the ECN account comes with US dollar, pounds, and Euros option with spreads starting as low as 0.11. Finally, you can trade using the FXTM pro, and Stock CFDs account with different requirements and features.

Customer Support

If you had any issue with using FXTM, the customer support system is always available to help. The broker has a sound customer support system, perhaps because it is a global forex broker and well-regulated. The customer desk is available for a customer all through the day with access to live chat, email, and phone calls.

Pros

- Great customer service

- Available of relevant educational materials

- Competitive fees

- Multiple account types

Cons

- Not ASIC regulated

- Most withdrawals have fees

- It doesn't offer cryptocurrency trading

Verdict

Overall, FXTM is a highly reliable trading platform with an option to use two different ECN accounts. The broker lays a lot of emphasis on customer care and educational content to equip its traders. Furthermore, the loyalty program is another essential feature that makes traders want to use the platform. With a lot of benefits, it is understandable why many prefer FXTM besides being well-established.

#4 XTB

Site: XTB.com

XTB is an online forex and CFD trading company founded in 2002. It is among the best 10 forex brokers offering ECN accounts in 2021 with access to over 2000 trading instruments on two different trading platforms.

This European broker has offices in over 13 countries, including Turkey, France, Germany, Poland, and the United Kingdom. Aside from these, it is a highly regulated broker with various authorities, including the CySEC, the Financial Conduct Authority, and the International Financial Services Commission.

Today, it has expanded to various new markets, including Latin America, Africa, and the Middle East.

Trading Platform

Besides the traditional MetaTrader platform, XTB offers traders its unique xStation 5 trading platform. In 2016, xStation 5 received the Online Personal Wealth award as the "Best Trading Platform."

The trading platform offers instant execution; no requotes, a comprehensive video tutorial section, real-time performance stats, a sentiment heatmap, etc. Furthermore, it is available on mobile, tablet, desktop, and a smartwatch. The innovative technical tool is something worth giving a shot at.

Trading Market

XTB offers financial instrument in six different categories, which include:

- Shares – CFD trading in over 1500 company shares in the US, the UK, Finland, France, Switzerland, Portugal, and Poland.

- Forex – provides over 50 currency pairs, including Major, minor, and exotics pairs.

- Cryptocurrencies such as Dash, Ripple, Litecoin, Bitcoin, Ethereum, etc.

- Commodities such as gold, platinum, silver, oil, coffee, wheat, Nickel, Aluminum, etc.

- Indices

- ETFs

Deposit and Withdrawal Options

XTB broker supports Skrill, Credit/debit cards, Neteller, bank wires, SafetyPay, and Paysafe. Credit/debit cards and bank wire comes free when you want to deposit, but other options come with a 2% deposit fee on the amount funded.

Withdrawal charges also apply for these payment systems and are processed within 24 hours. XTB accepts the following currencies: USD, EUR, GBP, and HUF.

Account Types

XTB offers three unique account types, which come with unique features. For instance, the standard account has a minimum spread of 0.5 pips, commission-free for commodities, forex, and indices. The other account includes the Islamic account, which offers a swap-free alternative, and the Pro version account with spread from 0.1 pip.

Customer Support

Traders can access customers’ 5-days a week with various convenient options such as phone calls, email, and live chat. Additionally, XTB offers a frequently asked question section to provide standard answers to questions that many traders ask. Customer support is available in Spanish, French, English, Arabic, Russian, Portuguese, etc.

Pros

- Easy to open an account

- Free and fast withdrawal and deposit

- Low forex fees

Cons

- High fees for stock CFDs

Verdict

If you want a broker that offers low deposit and withdrawal fees, you might consider using XTB. The broker is deemed to be safe due to its long track record in the industry. Furthermore, it always publishes its financial statements to showcase how transparent it is to its audience.

#5 FP Markets

Site: FPMarkets.com

Hardly can you mention the best 10 forex brokers offering ECN accounts in 2021 without mentioning FP Markets. It is an Australian forex and CFD broker founded in 2005; it is regulated by various regulatory bodies, including CySEC, ASIC, and the Financial Services Authority of St. Vincent and the Grenadines.

Trading Platform

Besides using the popular traditional trading platform – MetaTrader 4 and MetaTrader 5 that offers features such as 21 timeframes, 80+ technical indicators, 6 pending stop order types, and so on, it also has three additional trading platforms.

You can use the Iress Viewpoint, Iress Trader, and Iress Investor platform when trade. Each platform comes with unique features that include over 50 technical indicators, advanced order management, market depth, customizable alerts, live streaming news, and access to the market heatmap.

The Iress and MetaTrader platform comes with a mobile app that is downloadable for Android and iOS users.

Trading Market

You can trade six different markets on the FP platform. These include:

- Forex – Trade over 60 currency pairs

- Commodities – include Brent Crude oil and Commodity CFDs trading

- Cryptocurrencies – Trade Ethereum, Bitcoin, Bitcoin Cash, Ripple, and Litecoin

- Indices – Access to over 12 global indices

- Share CFDs – Access to over 10,000 shares or stocks

- Precious metals such as silver and gold in the spot market

Deposit and Withdrawal Options

FP Markets has a smooth deposit process that comes with zero fees. You can use bank transfer, PayPal, FasaPay, Online Pay, Skrill, credit/debit cards, BPay, and so on. Deposit is always instant besides those using bank transfer. The minimum deposit is 100 US dollars.

However, withdrawal comes with fees depending on the withdrawal option you choose. For withdrawal, you can also use the same deposit method. You can check the full details of its withdrawal policy on its website.

Account Types

For MetaTrader users, you can choose between a Raw or standard account suitable for new traders. However, if you opt to use the unique Iress platform, you can choose from a standard, platinum, or premier account. Each of these accounts comes with its unique features and instrument to trade. Furthermore, it also provides Islamic swap-free option for traders.

Customer Support

You can reach out to the customer support team from Monday to Saturday using live chat, contact number, and email. The live chat is available in 12 languages.

Pros

- Quick deposit and withdrawals

- Low forex fees

- Responsive customer support with educational tools

- Over 10,000 tradable financial instruments

- ECN pricing and ASIC regulated

Cons

- Choice of the market can be overwhelming for new traders

- Does not accept US clients

- No ETFs

Verdict

In all, FP Markets offers a reliable trading environment with the option to open DMA or ECN account. The multi-option trading platform gives traders a substantial choice with numerous financial instruments to trade, including cryptocurrencies, futures, CFDs, and forex. Finally, the sign-up process is swift and user-friendly makes FP Market a broker to consider if you are looking for the best 10 forex brokers offering ECN Accounts in 2021.

#6 Vantage FX

Site: VantageFX.com

Vantage FX is a leading online broker, part of the Vantage Group of Companies in Australia. Since 2009, the company has been active in the financial market, offering various trading services with over 180 assets traded.

It offers maximum leverage of 1:500 for traders with regulation from various authorities, including the Australian Securities and Investment Commission and Cayman Islands Monetary Authority.

Trading Platform

You can only trade with Vantage FX using the popular MetaTrader. The platform comes highly customizable with various tools in different languages. Nevertheless, it has developed different plugins to make the trading platform more unique. Mobile trading is available for iOS and Android users.

You can take advantage of additional products such as forex VPS, social trading, Pro Trader Tools, and its MT4 Smart Trader Tools.

Trading Market

You can trade six different markets on the FP platform. These include:

- Forex – Trade over 41 currency pairs

- Commodities – include Brent Crude oil and Commodity CFDs trading

- Cryptocurrencies

- Indices

- Share CFDs

Deposit and Withdrawal Options

There are numerous deposit and withdrawal methods for traders. You can leverage multiple deposit options such as cryptocurrencies, Bpay, Moneybookers, FasaPay, Neteller, Skrill, Union Pay credit/debit cards, etc; the withdrawal options include wire transfer and credit card.

However, some of these payment methods come with third-party fees where applicable. Each transaction varies but doesn't exceed five business days.

Account Types

Vantage FX offers traders three different account types with leverage up to 1:500 and a minimum deposit of $200. These accounts include standard STP, raw ECN, and pro-ECN; additionally, it provides access to Islamic Swap-free accounts along with demo account for those who want to learn to trade. These trading accounts come with promotions and bonuses with a 50% welcome bonus for new traders.

Customer Support

Vantage FX provides diverse customer service channels for its users. However, among these channels, live chat seems to be the fastest. You can use other options such as email and telephone, depending on what is suitable for you.

Pros

- Leverage up to 1:500

- Commission-free trading

- Promotion and bonus for new traders

Cons

- No UK or European regulations

- It doesn't allow US clients

- No 24/7 customer support

Verdict

Vantage FX remains the go-to platform for new traders or people who want to start trading using a little fund. The RAW ECN account is attractive for traders since it offers a better opportunity to traders. Generally, it is an excellent place to start; however, professional traders might prefer a bigger platform.

#7 Hankotrade

Site: Hankotrade.com

Hankotrade is an unregulated offshore broker that offers unique trading opportunities for traders. It started operation in 2019 with three different account types that offer commission from $0.

Despite being a new broker, it offers trading on various instruments, including commodities, indices, forex, and cryptocurrency. With a minimum deposit of $10, it tends to attract traders to its platform. However, it has a huge mountain to climb since it is unregulated, which poses a red flag for future investors or traders.

Trading Platform

You can trade using the standard MetaTrader 4, which is available for its customers on different versions. You can make use of the mobile or desktop version, depending on the one that suits you.

Trading Market

You can trade four different markets with Hankotrade.

- Forex – access to 62 currency pairs with fast execution speed

- Commodities – Access to instruments such as gold, silver, UK Oil, and WTI crude

- CFD Indices – Access to 11 major international stocks indices

- Cryptocurrencies – Over 9 cryptocurrencies to trade

Deposit and Withdrawal Options

When it comes to depositing, it has various acceptable cryptocurrencies, including Bitcoin, Ripple, Litecoin, Bitcoin Cash, and Ethereum. The equivalent amount is exchanged in your account, which could be in the following currencies – EUR, CAD, and USD.

Account Types

Hankotrade offers three different types of accounts – STP, ECN, and ECN plus. Each account type comes with different features with access to a global market. The STP account has a minimum deposit of $10 with spreads from 0.7pips and maximum leverage of 1:500. However, the ECN and ECN Plus accounts have a minimum deposit of $100 and $1000, respectively.

Full detail of each feature of these account types is available on its website. There is Islamic accounts for traders for religious purpose.

Customer Support

The broker offers support systems such as live chat, email, and social media. They also include tier office address in Seychelles for anyone who wants to visit. Nevertheless, the broker doesn't provide any phone contact for customers to call directly.

Pros

- Diverse trading tools

- Multiple trading instruments

Cons

- Not regulated

- No telephone supports

- Offshore broker

- Limited funding methods

Verdict

Hankotrade, although an ECN broker, which offers multiple financial instruments, doesn't have a lot going for it. Firstly, being not regulated is a red flag for most traders; additionally, they have limited educational materials, funding options, and telephone number for customers to call.

Overall, Hankotrade has to improve on these things if it wants to compete with other forex brokers in the industry.

#8 Trader's Way

Site: TradersWay.com

Trader's Way is a forex broker founded in 2011 with reliable trading platforms and flexible account options. Although it has a wonderful platform, the lack of regulation is a huge deterrent for most traders. Besides that, it has limited non-forex trading instruments and uses an ECN model to ensure it provides a transparent pricing system.

It provides access to trading to a global audience with a different range of markets such as Metals, Cryptocurrency, commodities, forex, and Energies. An attractive feature is its $5 minimum deposit and leverage up to 1:1000, which tend to attract traders. You can trade confidently since it doesn't have any restrictions on trading.

Trading Platform

It has a good selection of platforms to accommodate all levels of traders. They have the popular MetaTrader and advanced cTrader platform, available in its web and mobile versions. Furthermore, the trading platform has a QuickDeal tool that helps transform the MetaTrader platform into an advanced ECN/STP trading platform.

Trading Market

Trader's Way focus on three primary markets – Forex, Energies, and precious metals. These are all tradable on different trading platforms. The forex market offers traders over 45 currency pairs with a minimum lot size of 0.01 and leverage of 1:1000.

You can trade precious metals such as silver and gold as CFDs without buying the asset. Besides this, you can also trade natural gas and crude light oil. Finally, crypto is another new feature to its trading market that offers cryptocurrency trading. You can trade coins such as bitcoin, Ripple, and Ethereum.

Deposit and Withdrawal Options

There is nothing like a shortage of deposit and withdrawal options when you use Trader's Way. The broker is frequently improving its deposit and withdrawal option. Today, it offers credit cards, bank transfers, cryptocurrencies, Neteller, and Skrill for traders.

However, some platform comes with fees when making payment. A bank transfer generally takes a few days to clear, whereas other methods can be instant.

Account Types

There are various types available to choose from, depending on your strategy, taste, personal needs, and investment level. You have the option of selecting the MT4 (fixed spread), MT4 (Variable spread), MT4 (ECN account), cTrader (ECN), and MT5 (ECN account). Each account has its distinct features and requirements. For instance, the deposit minimum for the MT5 (ECN) is $100, whereas the MT4 (ECN) is $10.

Customer Support

Customer service is available through email, phone calls, and an online chat. For those in the US, a dedicated telephone number is allocated to each state to handle issues swiftly.

Pros

- It offers leverage up to 1:1000

- Wide range of account types

- Effective customer service

Cons

- It is not regulated

- Offers wide spread on different trading accounts

Verdict

Although it has a solid track record, the lack of regulation is a red flag for newer investors. Additionally, the high spread is another weakness of the broker. Nevertheless, Trader's Way offers different benefits to its customers with quick execution and a wide range of instruments to trade. Finally, with leverage of 1:1000, it is evident why most traders rush to trade with this broker.

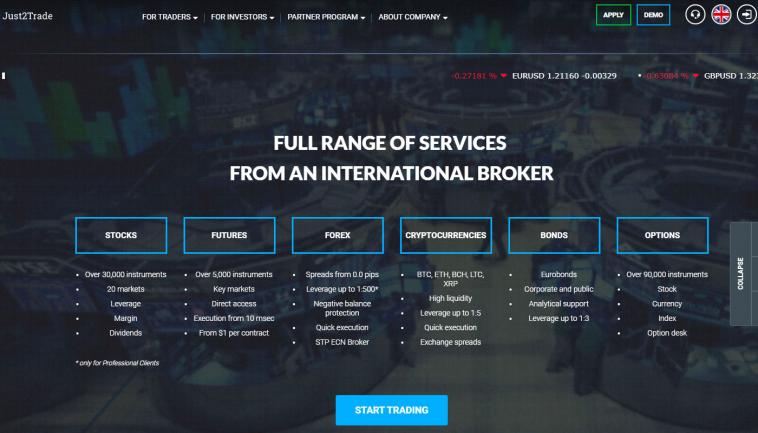

#9 Just2Trade

Site: Just2Trade.online

Just2trade is an online broker that offers options and stocks trading through professional trading apps and platforms. Founded in 2007, it emphasizes social trading before its acquisition took place in 2015. Today, it caters to traders who love trading high volume and focuses on competitive pricing.

CySEC regulates it with its headquarters in Cyprus. Additionally, it provides educational content for its traders with different platforms for trading.

Trading Platform

Similar to most brokers, Just2Trade offers the popular MetaTrader platform besides its unique CQG and ROX platforms. The CQG platform allows you to trade over 40 world exchanges with various options and futures trading.

However, the ROX platform gives direct access to exchanges in Mexico, Canada, Europe, and the USA. The platform is suitable for active traders or investors that use bigger size when trading. It comes with a lot of comprehensive functionalities but relatively easy to understand.

Trading Market

Just2Trade offers traders divers market and trading instruments, including bonds, mutual funds, futures options, ETFs, stocks, and futures. However, to manage these instruments from the same interface, you need a third-party trading application. It also provides trading for CFDs, cryptocurrencies, and forex for non-US clients.

Deposit and Withdrawal Options

There are over 22 methods to deposit funds to your account. This includes ACH (Automated Clearing House) transfer, OFX transfer, wire transfer, or an account transfer. However, you cannot fund an account using PayPal, traveler's checks, credit/debit card, Western Union, and Money orders.

Account Types

Just2trade has three account types depending on the trader's choice. It comes with the standard forex account, which is suitable for new traders with all costs included in the spread. The second account is the Forex ECN, which uses ECN execution with high speed, whereas the MT5 Global account offers better trading for traders that love high volume.

Customer Support

Just2trade provides the necessary steps to support its client. It has a 24/7 support system with professional analytical assistance. Customer support includes live chat, email, fax, and telephone.

Pros

- It provides access to social trading features

- Trade ETFs and stocks with as little as $2.5 fees

- Impressive customer support

Cons

- $2,000 minimum requirement to open an account

- You need a third-party if you want to use stock screeners

Verdict

If you are an independent trader, then Just2trade might appeal to you. Furthermore, swing traders can also take advantage of the platform as it offers lower costs with various resources and tools to help your trading. Generally, the platform is suitable for people who want access to social trading features, very competitive pricing, and a strong trade execution broker.

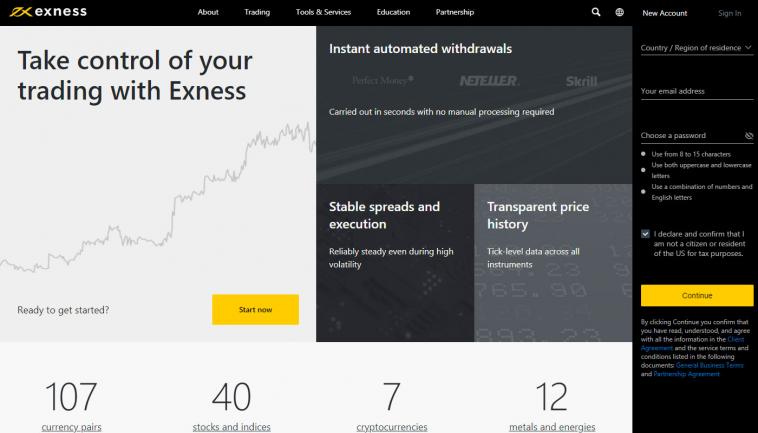

#10 Exness

Site: Exness.com

Although not a famous name, you will hear when you talk about forex brokers, it has found its ground in delivering a reliable platform for traders. Exness started in 2008 with just a few traders, but today, it has grown to over 15,000 traders with over 120 financial instruments cut across various markets.

The Exness website is user-friendly as it accommodates over 18 languages with various customer support systems for traders. Furthermore, traders have access to leverage and low spread when trading. More importantly, its deposit and withdrawal process is instant.

Trading Platform

The trading platform is available in MT4 Web Terminal, mobile trading platforms, MetaTrader 4 and 5. These platforms offer numerous tools for traders to analyze the market seamlessly. It comes with different technical indicator tools and a strategy tester.

Trading Market

Exness offers more than 150 instruments to trade, which include over 130 currency pairs. You can trade CFDs on agriculture and energies. However, it doesn't provide any cryptocurrency or indices trading.

Deposit and Withdrawal Options

Exness offers different deposit and withdrawal options for traders, including Perfect Money, Neteller, WebMoney, Skrill, Tether, Bitcoin, and so on. The minimum deposit fee is 1 dollar or pounds, depending on the deposit currency.

There is no bank wire, which many traders consider a limitation.

Account Types

Exness offers two different accounts – standard and professional accounts. The standard account has two accounts, which is the standard and standard cent. The minimum deposit is $1 as it offers traders high market execution, no requotes, and stable spreads.

The professional accounts include raw spread, zero, and Pro professional accounts. The minimum deposit is $500 and suitable for scalpers, day-traders, and Algo traders.

Customer Support

It provides multi-lingual supports on its website to make it easier for everyone using the platform. It also has a frequently asked question segment to answer relevant questions besides its email and phone contact. Regrettably, there is no option of a live chat, which would have gone a long way in helping clients.

Pros

- Regulated

- Unlimited Leverage

- Segregates client funds

Cons

- Not FCA regulated

- Limited range of instruments

Verdict

With over twelve years as a broker, it should improve in providing quality service to clients. The absence of live chat and the popular trading instrument is a limitation to its progress. While its minimum deposit of $1 is an attractive feature, it needs to up its game in an ever-growing financial industry.

Conclusion

With so many forex brokers that offer ECN accounts, it can be a daunting task to pick the best. However, in this review of the best 10 forex brokers offering ECN accounts in 2021, we have made it easier for you to make a decision. You can look at the platform they offer, market options, customer support, pros, and cons to make a judgment.

The essence of an ECN account is to allow traders to trade profitably and better; thanks to the forex industry's competitive nature, ECN brokers offer transparency, anonymity, lack of price manipulation, and instant execution of trade orders. Furthermore, they are more secure and reliable for traders.